Where to Find the Sba Ppp Loan Number

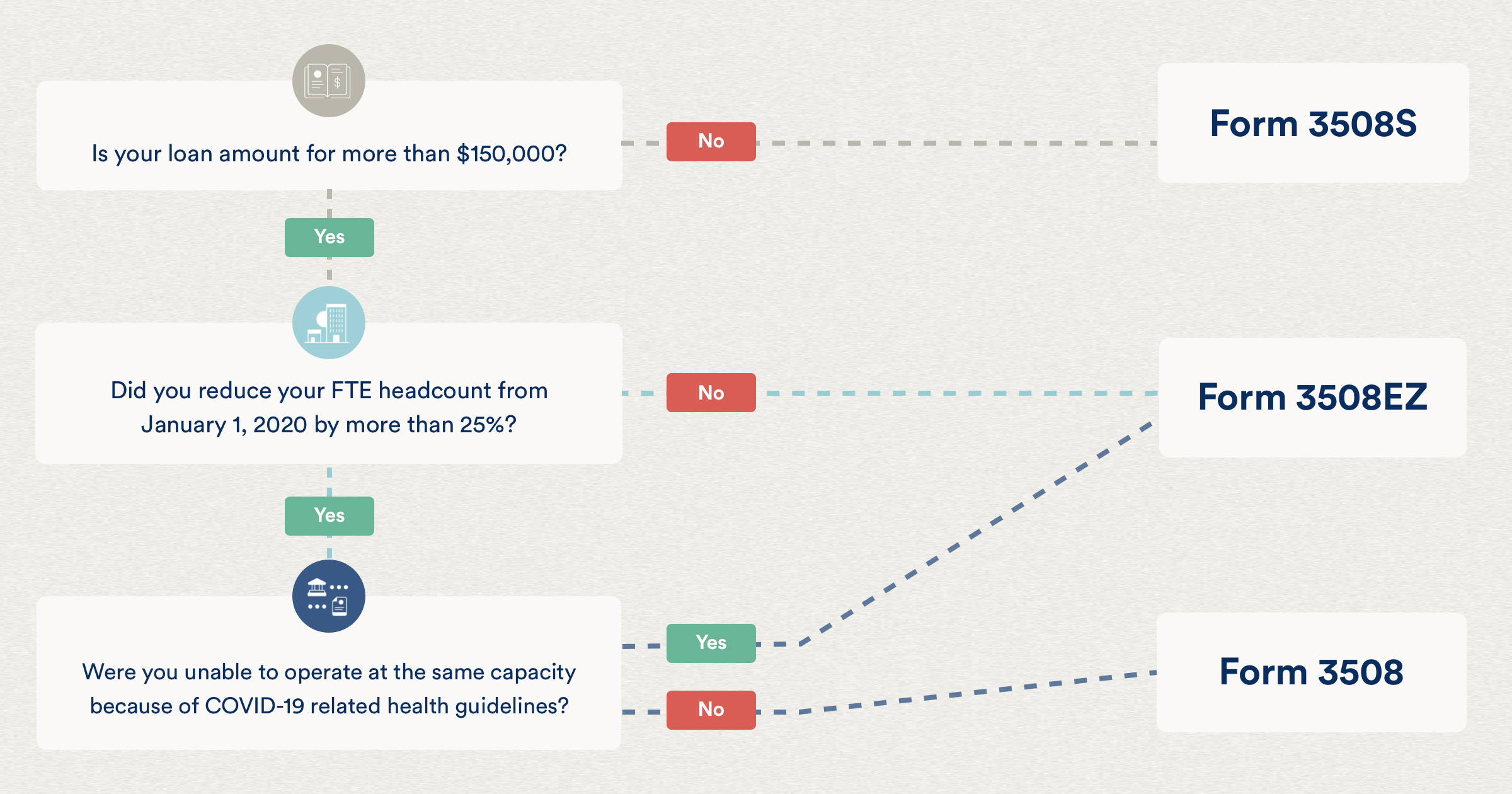

Note: If you're self-employed, you can save time applying for PPP forgiveness with the new EZ Form. Here's how to fill out the simplified SBA Form 3508EZ. For loan amounts less than $150,000, you can use the new Form 3508S.

On May 18, the SBA released the official form you'll need to fill out in order to apply for forgiveness on your PPP loan, also known as SBA Form 3508. But it's not the simplest form to fill out.

In this guide, we explain each section and walk you through exactly how to fill out this form to get your loan forgiven.

Download the Forgiveness Application (PDF)

Here's how to tackle this form:

- Complete basic company information on the main Loan Forgiveness Calculation form

- Complete Schedule A Worksheet to see if you meet the headcount and pay requirements

- Complete Schedule A to find your payroll and compensation costs

- Complete the rest of the Loan Forgiveness Calculation Form to determine your total eligible costs and our forgiveness amount

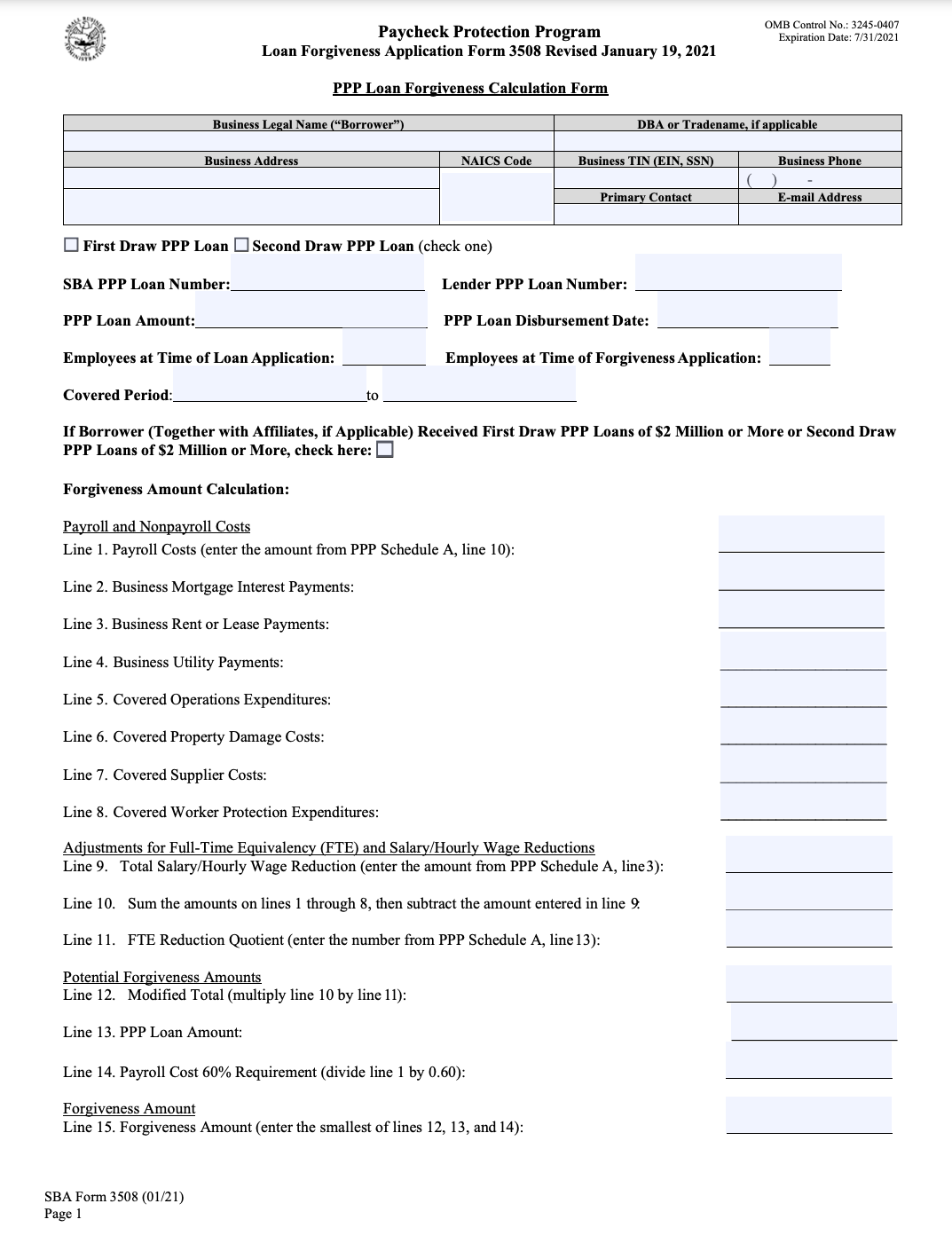

Page 1: PPP Loan Forgiveness Calculation Form

Business Legal Name ("Borrower") DBA or Tradename, if applicable

Enter the same business name used on your PPP application, which should be identical to the name you use on your tax returns.

Business Address/Business TIN (EIN, SSN)/Business Phone/Primary Contact/E-mail Address

Use the same information as on your PPP application unless the information has changed.

SBA PPP Loan Number

This is your E-tran number that the SBA generated for you. Each business gets one E-tran number per PPP loan. If you have multiple businesses and multiple PPP loans, you will have more than one E-tran number. If you don't know where to find this number, speak to your lender—they'll have it on file.

Lender PPP Loan Number

The number the lender has assigned to your loan in their systems. You can find this on your signed loan docs. If you can't find it, your lender will be able to provide it for you.

PPP Loan Amount

The full loan amount you received. You can confirm this amount in your bank records, PPP loan agreement, or in a confirmation email. Your lender should not have charged fees or otherwise taken any amount away.

PPP Loan Disbursement Date

The day the funds arrived in your bank account. You should be able to see this in your bank records or in your online banking portal. If your funds were sent in stages, enter the first date.

Employees at Time of Loan Application/Employees at Time of Forgiveness Application

Enter the number of actual employees, not Full-Time Equivalents (FTE).

Covered Period

Calculate the period starting from your disbursement date to 24 weeks (168 days) after. If you received your PPP loan before June 5, 2020 you can use an eight-week (56-day) period. If you received your loan prior to December 27, 2020, the Covered Period can't go past December 31, 2020.

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million

Check if applicable to you.

Forgiveness Amount Calculation

You can skip this page for now. You'll need to complete Schedule A first to get the figures you need, which we'll find by starting on the Schedule A Worksheet first.

Now that that's done, we can move on to page 4.

Page 4: PPP Schedule A Worksheet

Table 1

List every single employee on your payroll during the Covered Period (or the Alternative Payroll Covered Period). Do not include anyone who does not live in the US, any independent contractors, yourself, or your partners.

Also do not include anyone who received an annualized pay rate of more than $100,000 in 2019. Those employees are to be listed on Table 2.

Employee's Name

Full name

Employee Identifier

Last 4 digits of SSN (Social Security Number)

Cash Compensation

The employee's compensation over your Covered Period, which includes:

- gross salary

- gross wages

- gross tips

- gross commissions

- paid leave (vacation, family, medical or sick leave, not including leave covered by the Families First Coronavirus Response Act)

- allowances for dismissal or separation paid or incurred during the Covered Period or the Alternative Payroll Covered Period

Each individual's compensation cannot exceed an annualized salary of $100,000.

Average FTE

Calculate the average number of hours paid per week, divide by 40, and round to the nearest tenth. Maximum value of 1.0. For simplicity, you can choose to use 1.0 for anyone who works 40 hours or more, and 0.5 for anyone else.

Further reading: How to Calculate FTE for the PPP

Salary / Hourly Wage Reduction

This is where you calculate if you've met the forgiveness requirements for maintaining pay.

For each employee, complete the following steps:

Step 1: Determine if pay was reduced more than 25%

Compare the employee's pay during the covered period (or alternative payroll period) to the pay between January 1 to March 31. If pay decreased by less than 25%, enter 0. Otherwise, proceed to the next step

Step 2: Determine if the Salary/Hourly Wage Reduction Safe Harbor is met

-

The employee meets the Safe Harbor requirements if these two conditions apply:

-

The average annual salary or hourly wage on June 30 is equal to or greater than the average annual salary or hourly wage on February 15

-

The average annual salary or hourly wage between February 15 and April 26 was lower than it was on February 15

-

If those conditions apply, the employee has met the Safe Harbor requirements. Enter 0. Otherwise, proceed to the next step.

Further reading: Safe Harbor Rules for PPP Loan Forgiveness

Step 3: Determine the Salary/Hourly Wage Reduction

-

Determine the difference in salary/wage by subtracting the pay the employee's pay during the covered period (or alternative payroll period) from 75% of the pay between January 1 to March 31

-

For hourly workers:

- Multiply the calculated difference by the average number of hours worked per week between January 1 and March 31. Multiply by 24 to get the full 24-week equivalent (multiply by 8 if you are using an 8-week Covered Period). Enter this amount.

-

For salaried employees:

- Enter the 24-week equivalent of the difference in salary by multiplying by 24/52 (use 8/52 if you are using an 8-week Covered Period).

FTE Reduction Exceptions

If you had any employees you could not hire back, their FTE can be included here. They can be included if the position was not filled by a new employee and they meet one of the following conditions:

-

The employee rejected your good-faith, written offer to rehire them at the same pay rate/hours as before

-

They were were fired for cause

-

They voluntarily resigned

-

They voluntarily requested and received a reduction of their hours

Table 2

Follow the same process as Table 1, but only considering employees who were paid an annualized rate of more than $100,000 for any pay period in 2019.

FTE Reduction Safe Harbor

This is where you calculate if you've met the forgiveness requirements for maintaining pay.

Calculate the following FTEs. We'll do the required calculations later on.

-

Total average FTE between February 15 and April 26. Record on Step 1

-

Total FTE in your pay period that includes February 15. Record on Step 2

-

Total FTE on June 30. Record on Step 4

Further reading: How to Calculate FTE for the PPP

Great! Now we can proceed to Schedule A on page 6.

Page 3: Schedule A

Self-employed individuals without payroll can skip lines 1 through 8.

Line 1

From the worksheet, Box 1.

Line 2

From the worksheet, Box 2.

Line 3

From the worksheet, Box 3.

If all your employees were paid at least 75% of their original pay (between January 1 and March 31), check the box and enter 0.

Line 4

From the worksheet, Box 4.

Line 5

From the worksheet, Box 5.

Lines 6 to 8

Enter the employer-paid expenses for employee health insurance, retirement plans, and state and local taxes on payroll.

Line 9

Enter the compensation paid to yourself and your partner(s). For self-employed individuals, this is where you can enter your owner compensation replacement. Partnerships (or in general, if any other individuals were compensated as an owner), include a separate table that lists how the compensation was paid out (names and amounts).

Line 10

Sum lines 1, 4, 6, 7, 8, and 9.

Full-Time Equivalency (FTE) Reduction Calculation

If you satisfy any one of the following three criteria, check the appropriate box to claim the Safe Harbor, skip lines 11 and 12, and enter 1.0 on line 13.

No reduction in employees or average paid hours

You did not reduce the number of employees or the average number of paid hours of your employees between January 1 and the end of your Covered Period

FTE reduction Safe Harbor 1

Between February 15 and the end of your Covered Period, you were unable to operate at the same level of business activity as before February 15 because you were in compliance with health guidelines or requirements set out by government health agencies (the Secretary of Health and Human Servies, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration).

FTE Reduction Safe Harbor 2

Refer back to the FTE Reduction Safe Harbor section on the Schedule A Worksheet. If Step 2 is less than Step 1, complete lines 11, 12, and 13. Otherwise, if Step 4 is greater than Step 2, check the box and enter 1.0 on line 13. Otherwise, complete lines 11, 12, and 13.

Line 11

Average FTE for one of the following periods

-

February 15, 2019 to June 30, 2019

-

January 1, 2020 to February 29, 2020

Seasonal employers can use either period, or any consecutive twelve-week period between May 1, 2019 and September 15, 2019.

Line 12

From the worksheet, the sum of Box 2 and 5.

Line 13

If you did not satisfy the FTE reduction exemptions, divide line 12 by line 11 and enter the result. If the result is greater than 1.0, enter 1.0.

Congratulations, you've completed Schedule A! Return back to page 3 (instructions below).

Finishing Page 1: PPP Loan Forgiveness Calculation Form

Line 1: Payroll Costs

From Schedule A, line 10.

Line 2: Business Mortgage Interest Payments

Enter the sum of interest payments on any business mortgages that were in effect before February 15, 2020. Prepayments are not allowed. You do not need to report any expenses you don't want to claim for forgiveness.

Line 3: Business Rent or Lease Payments

Enter the sum of business rent or lease payments, where the rent/lease agreement was in effect before February 15, 2020. You do not need to report any expenses you don't want to claim for forgiveness.

Line 4: Business Utility Payments

Enter the sum of business utility payments, where the utility agreement was in effect before February 15 2020. You do not need to report any expenses you don't want to claim for forgiveness.

Line 5: Covered Operations Expenditures

Enter the sum of any software, cloud computing, or other human resources and accounting needs (like Bench). You do not need to report any expenses you don't want to claim for forgiveness.

Line 6: Covered Property Damage Costs

Enter the sum of any costs from damages due to public disturbances occurring in 2020 and not covered by insurance. You do not need to report any expenses you don't want to claim for forgiveness.

Line 7: Covered Supplier Costs

Enter the sum of any purchase order or order of goods made prior to receiving a PPP loan essential to operations. You do not need to report any expenses you don't want to claim for forgiveness.

Line 8: Covered Worker Protection Expenditures

Enter the sum of any personal protection equipment or property improvements to remain COVID compliant from March 1, 2020 onwards. You do not need to report any expenses you don't want to claim for forgiveness.

Line 9: Total Salary/Hourly Wage Reduction

From Schedule A, line 3.

Line 10: Sum the amounts on lines 1 through 8, then subtract the amount entered in line 9

This is the preliminary amount of eligible forgivable expenses, accounting for any reduction due to not meeting the 75% pay requirement, but not yet accounting for the FTE requirement.

Line 11: FTE Reduction Quotient

From Schedule A, line 13.

Line 12: Modified Total

Multiply line 10 by line 11.

This is the final amount of eligible forgivable expenses, accounting for any reductions due to not meeting the FTE or pay requirement.

Line 13: PPP Loan Amount

The same value you listed previously.

Line 14: Payroll Cost 60% Requirement

Divide line 1 by 0.60 to determine the maximum forgivable amount possible.

Line 15: Forgiveness Amount

Enter the smallest of lines 12, 13, and 14.

——

Congratulations, you've completed all the required calculations! Make the required representations and certifications and sign.

More PPP resources

- PPP Loan Forgiveness: The Complete Guide

- PPP Forgiveness: 8 Weeks vs. 24 Weeks

- Self-Employed Guide to the PPP Forgiveness Application (SBA Form 3508EZ)

- My PPP Loan is the Wrong Amount. What Can I Do?

- How to Use The PPP Loan and EIDL Together

What's Bench?

We're an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We're here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of bookkeeping.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Where to Find the Sba Ppp Loan Number

Source: https://bench.co/blog/operations/ppp-forgiveness-application-form/

0 Response to "Where to Find the Sba Ppp Loan Number"

Post a Comment